How to Apply for MBNA Rewards World Elite Mastercard Credit Card

The MBNA Rewards World Elite Mastercard offers a robust rewards program, earning up to 2 points per dollar on select purchases with no cap. Enjoy travel perks, an annual bonus of 10,000 points for spending thresholds, and a generous welcome bonus, making it perfect for maximizing everyday spending and travel savings.

How to Apply for National Bank Personal Loans Quick Guide Tips

National Bank Personal Loans offer tailored loan amounts, competitive interest rates, and flexible repayment options, ensuring affordability and convenience. With transparent fees and clear conditions, these loans provide a reliable financial solution for Canadians looking to manage their finances effectively and without hidden surprises.

Learn How to Apply for the MBNA Smart Cash Platinum Plus Mastercard Credit Card

The MBNA Smart Cash Platinum Plus Mastercard Credit Card offers up to 5% cash back on groceries and gas, 2% thereafter, and 0.5% on other purchases, all without an annual fee. Enjoy purchase protection, an extended warranty, and a generous welcome bonus, making it an excellent choice for budget-conscious shoppers.

Apply Online for MBNA True Line Gold Mastercard Credit Card Today

Unlock significant savings with the MBNA True Line Gold Mastercard — featuring a low interest rate, no annual fee, and security with Zero Liability fraud protection. Perfect for consolidating high-interest debts and safeguarding your finances, this card offers both financial savvy and peace of mind.

How to Apply for a National Bank Syncro Mastercard Credit Card

The National Bank Syncro Mastercard offers a low variable interest rate, comprehensive purchase protection, and flexible payment options, making it ideal for managing finances. It facilitates easy balance transfers with promotional rates and enhances security with features like fraud alerts and zero liability protection.

How to Apply for the NEO Credit Card Easy Steps for Approval

The NEO Credit Card offers up to 5% cashback on everyday purchases without annual fees. Enjoy flexible credit limits to enhance your financial health and robust security features for peace of mind. Plus, maximize savings with exclusive partner discounts across various categories. Sign up today to unlock these benefits.

How to Apply for the AMEX Business Platinum Card Step-by-Step Guide

The AMEX Business Platinum Card offers unrivaled perks such as access to over 1,200 global airport lounges, exclusive events, and comprehensive travel insurance. Manage expenses efficiently, earn valuable rewards, and enjoy seamless travel with the membership rewards program, enhancing both business productivity and lifestyle.

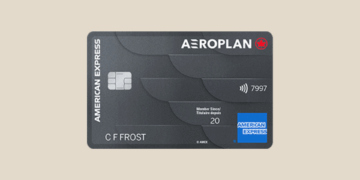

How to Apply for the AMEX American Express Aeroplan Card Credit Card

The AMEX American Express Aeroplan Card enhances travel with 1.5 Aeroplan Points per dollar spent, free first checked bag on Air Canada, and preferred seating. Comprehensive travel insurance and exclusive Amex offers further elevate your lifestyle and adventures, providing peace of mind and enriched experiences.

How to Apply for the National Bank Platinum Mastercard Credit Card

The National Bank Platinum Mastercard offers travelers comprehensive insurance, access to over 1,200 exclusive airport lounges, and a rewarding points program for everyday purchases. Enjoy peace of mind with purchase protection, extended warranties, and the freedom to turn spending into exclusive offers or travel experiences.

Tips for Saving Energy at Home: Reducing Bills and Helping the Environment

This article explores effective strategies for saving energy at home, highlighting the historical context of energy consumption while offering practical tips. By adopting energy-efficient appliances, programmable thermostats, and smart home technology, households can reduce bills, lower their carbon footprint, and contribute to environmental sustainability.